Report

Clean Energy Group, the Brookings Institution and the Council of Development Finance Agencies have just released a new paper on a powerful but underutilized tool for future clean energy investment: state and local bond finance.

In the first blueprint of how a city could become more “power resilient,” this report shows how Baltimore and other cities could use clean energy to create a more reliable electric system that protects vulnerable citizens during power blackouts.

NYSERDA recently issued bonds through a highly innovative structure to finance and refinance loans under the Green Jobs-Green New York program. This bond issuance marks a monumental accomplishment for the clean energy and bond finance industries.

This paper identifies several financing strategies at the state and municipal level that can be adapted and implemented to accelerate the clean energy finance revolution in other states and cities, and at the federal level.

By adopting appropriate incentives, definitions and safeguards, states could use their existing RPSs to support increased energy resiliency at critical facilities, while simultaneously promoting the increased deployment of clean energy resources.

A comprehensive analysis of the economic costs and benefits of developing offshore wind industry in the United States.

A state-driven federal clean energy finance initiative would effectively leverage private financing for clean energy development, according to a proposal published by the Clean Energy and Bond Finance Initiative (CE+BFI) for Congress to consider.

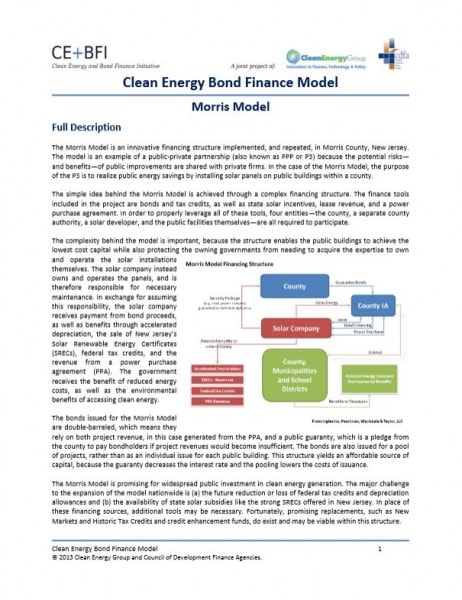

The ‘Morris Model,’ named for a financing structure originated in Morris County, New Jersey, leverages bond financing to achieve relatively low cost capital for renewable energy.

The Industrial Development Bond (IDB) model leverages bond financing to achieve relatively low cost capital for renewable energy.

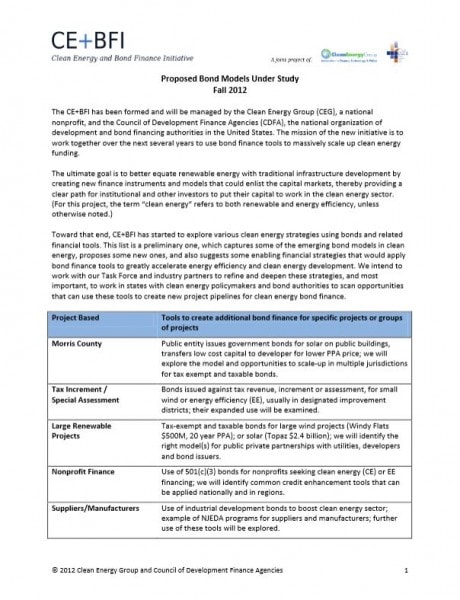

Preliminary document exploring the most promising bond instruments that can be used for clean energy.