February 22, 2024

What Nonprofits Need to Know about the Investment Tax Credit

By Anna Adamsson

Click here to read an updated version of this blog for 2025.

The Inflation Reduction Act of 2022 (IRA) updated and expanded the Investment Tax Credit (ITC) for solar and battery storage resilient power projects. The ITC, which was previously set at a 26% credit for 2023 and a 10% credit for every year after that, was updated and raised to cover 30% of the eligible project installation costs through 2032. This change significantly increases the anticipated savings for solar projects and will help create stability in the market over the next decade.

Congress also expanded the ITC in three crucial ways: 1) Nonprofits with no tax liability can now apply for direct pay reimbursement equal to the value of the tax credit 2) Storage-only projects are now eligible for the ITC. 3) The ITC now includes several ‘bonus credits’, which can significantly increase savings for projects serving low-income and underserved communities. These important changes are outlined in further detail below.

Can nonprofits benefit from the Investment Tax Credit?

Importantly, the ITC can now benefit everyone, not only those that have tax liability. Nonprofits and other tax-exempt entities – like municipalities and Tribal governments – are eligible to receive the ITC in the form of a direct pay reimbursement.

To learn more about the Direct Pay process and project eligibility, view the Direct Pay Fact Sheet.

Direct Pay, also referred to as Elective Pay, enables tax-exempt entities to receive payment equal to the full value of the Investment Tax Credit (ITC) and its bonus credits after a clean energy project has been “placed in service“. To participate in Direct Pay, tax exempt entities must alert the IRS in that year’s tax return and through the IRS pre-filing registration form.

Clean Energy Group published the guide “What Nonprofits Need to Know When Applying for Direct Pay” to help tax-exempt entities navigate the key steps to receiving direct pay reimbursement. The guide also includes a customizable timeline, which makes it easier for projects to track progress through those steps and ensure that no deadlines are missed.

What kind of clean energy technology is eligible?

The ITC formerly could only be applied to energy storage if it was installed with solar or wind power. Now standalone storage projects, in addition to solar only and solar combined with storage projects, are eligible for the ITC. The change to include storage only projects will increase access to storage, including for organizations who have already installed solar and may now want to explore adding resilient battery storage to their facility.

Currently eligible projects include solar, energy storage, microgrid controllers, and small wind projects. The credit also extends to fuel cells, biogas, and combined heat and power properties. The eligibility requirements change for projects placed in service after December 31, 2024, as described in Tax Code Setion 48E. In 2025, to be eligible projects must generate electricity with a greenhouse gas emissions rate that is not greater than zero, such as solar and wind. It will also continue to include qualified energy storage technologies.

Energy storage, as defined in 26 U.S. Code §§ 48E(c)(2) and 48(c)(6), includes “property … which receives, stores, and delivers energy for conversion to electricity … and has a nameplate capacity of not less than 5 kilowatt hours”. It does not include storage “primarily used in the transportation of goods or individuals and not for the production of electricity”.

How much is the ITC worth?

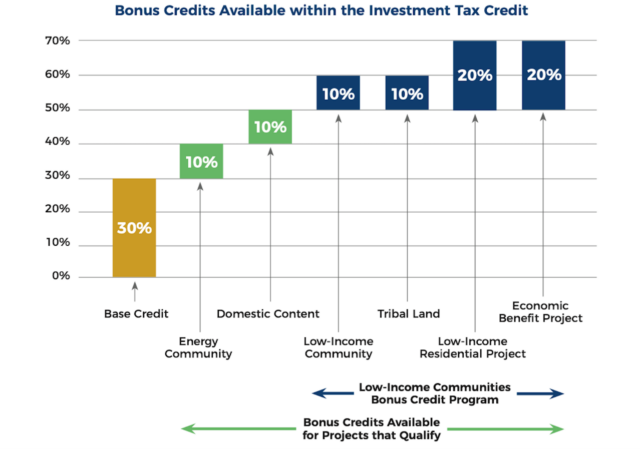

The ITC was increased to 30% baseline credit for projects ‘placed in service’ before 2033 (or sooner if emissions targets have been met, see New Clean Electricity Investment Tax Credit 48E). This applies both to projects under one megawatt capacity and to larger projects that meet prevailing wage and apprenticeship requirements. Projects may be eligible for up to six bonus credits that could raise the value of the ITC up to 70% of the eligible costs of the project’s installation.

What are the Bonus Credits?

The ITC includes six different bonus credits that projects may apply for. Four of those credits are housed within the Low-Income Communities Bonus Credit Program. Projects can only apply for one of the four bonus credits within the Low-Income Communities Bonus Credit Program. This means a project could either receive a 10% or 20% bonus credit, depending on their eligibility.

The four bonus credits within the Low-Income Communities Bonus Credit Program are:

- 10% bonus for projects located in a low-income community (mapping program indicating potential eligibility)

- 10% bonus for projects located on Tribal Land

- 20% bonus for projects when the facility is part of a qualified low-income residential project

- 20% bonus for projects when the facility is part of a qualified low-income economic benefit project

The ITC also includes two additional 10% credits, which are stackable. Projects who are eligible can apply for both bonus credits, in addition to the 30% baseline credit and one of the bonus credits within the Low-Income Communities Bonus Credit Program.

The two stackable bonus credits (§ 48) are:

- 10% bonus for projects located in an “energy community” (mapping program indicating potential eligibility)

- 10% bonus for projects that meet domestic manufacturing requirements

Learn more about each of these six bonus credits in a series of fact sheets that CEG published. To read about the application process for the Low-Income Communities Bonus Credit Program, view this post.

What is the application process like for these incentives?

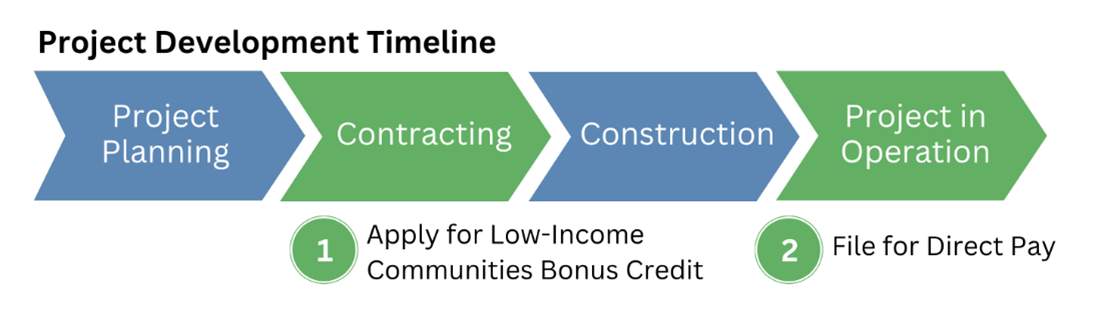

The ITC baseline credit and Direct Pay are not subject to competitive application cycles. Instead, all eligible tax-exempt entities that meet the requirements for the ITC and that file appropriately will receive the ITC through Direct Pay. Projects must file for Direct Pay after the clean energy project has been “placed in service”, which is shown in Step 2 of the Project Development Timeline figure, shown below. Learn more about the process to apply for Direct Pay in this guide.

Although the ITC and Direct Pay are available to all eligible projects, the four bonus credits within the Low-Income Communities Bonus Credit Program only have limited annual capacity. Eligible project teams can apply for a “capacity allocation” once they have a contract in place for the project, indicated in Step 1 of the Project Development Timeline figure. Projects may also need additional documentation depending on which of the bonus credits the project is applying for. The project team must apply for and receive a capacity allocation before the project has been placed in service. Learn more about the application process for the Low-Income Communities Bonus Credit Program in this post.

Resource Library

Direct Pay for Tax Exempt Entities

Tax exempt entities and governmental entities are now able to access the Investment Tax Credit and its bonus credits through Direct Pay reimbursement, also referred to as Elective Pay. To learn more about the Direct Pay option and the process to receive Direct Pay reimbursement, visit:

- Clean Energy Group Direct Pay Fact Sheet

- Clean Energy Group Direct Pay Guide for Nonprofits, which includes an in-depth look into the application process and access to a customizable application timeline

- Lawyers for Good Government: Elective Pay & IRA Tax Incentives Resources Page

- IRS Elective Pay and Transferability webpage, which links to relevant resources and fact sheets

- IRS Elective Pay Frequently Asked Questions

- White House Direct Pay through the Inflation Reduction Act webpage

Investment Tax Credit and its Bonus Credits

Clean Energy Group and Clean Energy States Alliance published several blog posts and resources about the updates to the Investment Tax Credit and the impact of the Inflation Reduction Act including:

- Investment Tax Credit Fact Sheets: Bonus Credit Program

- Low-Income Communities Bonus Energy Investment Credit Program: Answers to Frequently Asked Questions

- How to Make the Most of the Investment Tax Credit: Applying for Bonus Credits

- Carveouts within the Low-Income Communities Bonus Credit Program Prove Meaningful, but Underutilized

- The Inflation Reduction Act Offers Powerful Tools for Solving the Peaker Problem

- The Inflation Reduction Act is a Game Changer for Nonprofits Seeking Solar+Storage

What if I have more questions?

You can reach out to Anna from Clean Energy Group ([email protected]). Clean Energy Group nor its employees are or may act as tax advisors. Projects should seek professional tax advice before making decisions.

Treasury Department Guidance

| Program | Existing Guidance | Anticipated Future Guidance | Application Process |

| Direct Pay Reimbursement | Notice of Proposed Rulemaking (2023-12798, June 14, 2023) Pre-Filing Registration Temporary Regulations (2023-12797, June 14, 2023) | The IRS should release final regulations. | Projects installed in the 2023 tax year should file for direct pay this spring. Learn more. |

| 10% Bonus Credit Low-Income Community | Initial Guidance (Notice 2023-17, February 13, 2023) Notice of Proposed Rulemaking (2023-13510, June 1, 2023) Final Regulations (2023-17078, August 15, 2023) Revenue Procedure (Rev. Proc. 2023-27, August 15, 2023) | The IRS could amend the capacity allocation and application process (described in this 2023 blog post) for future application cycles. | The 2023 application portal opened on October 19, 2023. As of February 2024, limited capacity remains available. The 2024 program cycle will open later this year. |

| 10% Bonus Credit Tribal Land | |||

| 20% Bonus Credit Affordable Housing | |||

| 20% Bonus Credit Economic Benefit Project | |||

| 10% Bonus Credit Energy Community | Initial Guidance (Notice 2023-45, April 7, 2023) Updated Guidance (Notice 2023-29, June 15, 2023) | The IRS should release proposed regulations and, later, final regulations. | Projects that began construction on or after 1/1/2023 can be eligible. |

| 10% Bonus Credit Domestic Manufacturing | Initial Guidance (Notice 2023-38, May 12, 2023) Supplementary Guidance (Notice 2024-9, Dec. 28, 2023) | The IRS should release proposed regulations and, later, final regulations. | Projects that began construction on or after 1/1/2023 can be eligible. |

Visit the Treasury Department’s webpage for an update-to-date index of all notices and procedures published on Inflation Reduction Act-related tax incentives and policies including Direct Pay, the Investment Tax Credit (§ 48), the Low-Income Communities Bonus Credit Program (§ 48(e)), and the bonus credits for energy communities and for domestic content. The Inflation Reduction Act (Public Law No: 117-169 (8/16/2022)) lays the groundwork for each of these programs.

This blog post was originally published in February 2023, and was updated in February 2024.